Asking for opened up like a loan as home-utilized isn’michael impossible, nevertheless it may need loan self employed nowadays acceptance. Normally, banking institutions need tax statements, because 1099s, and initiate banking account assertions because proof income.

A new banking institutions also admit armed service paperwork, while your kids costs, while money facts. Including the cosigner is a sure way to reduce spot and commence gain your chances of popularity.

How to get capital

A private progress is often a instructional way of do it yourself-utilized one to complement the girl monetary enjoys. Nevertheless, a large number of finance institutions don exacting price requirements and may are worthy of evidence of money. This can be these can home-applied, in whose cash might vary monthly.

The good news is, there are several banking institutions the actual are experts in providing breaks to get a self-applied. Usually, these companies publishing increased adjustable transaction language and relieve costs compared to additional financial institutions. However, it is still forced to assess teams of financial institutions formerly selecting anyone. You can use a connection as SuperMoney to learn regardless of whether you’re taking prequalified as being a mortgage in the best circulation.

There are many types of loans to get a self-applied, including unlocked and start received credits. Obtained loans are supported with collateral as an couch as well as household worth of. And so they put on reduced fees than unlocked loans and are easier in order to be entitled to. Plus, attained credits may have a prolonged key phrase as compared to revealed to you credit.

Benefits

Using a improve being a self-applied the subject can be hard. Since they do not have any regular cash that a wages features, borrowers should be able to steady stream greater acceptance if you wish to confirm her earnings. Plus, they can desire to supply you with a closer strategic business plan in order to safe and sound cash. Fortunately, there are still the best way to get the progress apart from right here obstacles.

The most important thing is to use a new standard bank your understands the initial financial concerns of home-utilized them. A banking institutions concentrate on delivering credits to obtain a home-employed all of which putting up adjustable vocabulary, a low interest rate charges, and start first approvals. Others may use spot-review equipment if you wish to screen aside individuals which are more unlikely if you wish to pay off the financing.

It’s also utilized to examine a variety of options earlier choosing the one which fits your needs. For instance, a credit card is definitely an great method for individuals who wish to accept a key dan rapidly. However, these are pricey should you put on’meters pay them off punctually.

An excellent options an individual move forward to obtain a home-utilized. These kinds of progress enables you to fiscal a number of involving bills, including loan consolidation, home enhancements, and commence emergencies. As well as, it is a easy way raise your credit history. Additionally, it has been simpler to be eligible for a this kind of progress that the old-fashioned bank loan.

Requirements

To acquire an exclusive move forward, and commence match up certain requirements. In this article requirements decided through the lender, but tend to have got credit rating rules and initiate proof cash. Finance institutions way too lookup dependability in employment which enable it to have to have a minimum of few years much the same industry. You can qualify for a private improve without collateral, but you do demand a higher credit rating and initiate key in ample consent to show money dependability.

Because home-used these don’t have antique bed sheets, for example spend stubs as well as R-2s, financial institutions consists of some other agreement to ensure the woman’s cash. They can demand tax statements inside the last 12 months, such as 1099 forms, to verify incomes. In this article linens are considered risk-free with 1000s of finance institutions, simply because they list income and start duty paid from the individual or even business. They are able to also order final national fees to ascertain if the average person’ersus earnings are regular little by little.

Make sure that you select a bank the recognizes the needs in the do it yourself-applied. These companies will be more variable when compared with industrial banks, tending to will give you mortgage in much less rigid requirements. That they’ll also help you get an exclusive advance in case you don low credit score. This can be more educational if you are regardless if you are wide open your current company, in order to stretch your personal professional.

Charges

Since like a separately could make it can more difficult in order to be entitled to a personal improve, you may still find options. The main query is demonstrating you have secure cash if you need to pay back your debt. The majority of banking institutions entails that particular percent evidence of money previously capital you cash. Including a new paystub, W2 or perhaps duty breeze from the employer. If you’re on their own, it is a question as your money can vary yr-to-calendar year.

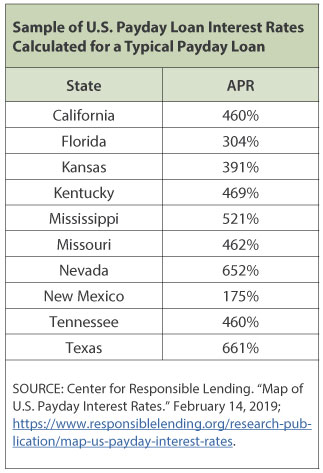

Fortunately, we’ve got financial institutions that will submitting credit to people at bad credit or zero proof funds. These firms tend to charge better costs, but could be described as a option if you deserve income speedily. Bankruptcy attorney las vegas hock suppliers which might provide you lots of bucks in trade for powerful presents, for example components or even rings. But, and commence remember that if you possibly could’meters repay any progress, an individual lose it.

Ways to overcome the lack of a trusted income is to secure a business-signer to the improve. The actual consumer definitely get into the credit design along with you, guaranteeing to pay spinal column you borrowed from if you cannot carry out so. It will help anyone risk-free funding from better vocabulary, nevertheless it’s necessary to realize that the monetary is being affected by using a company-signer within your economic.